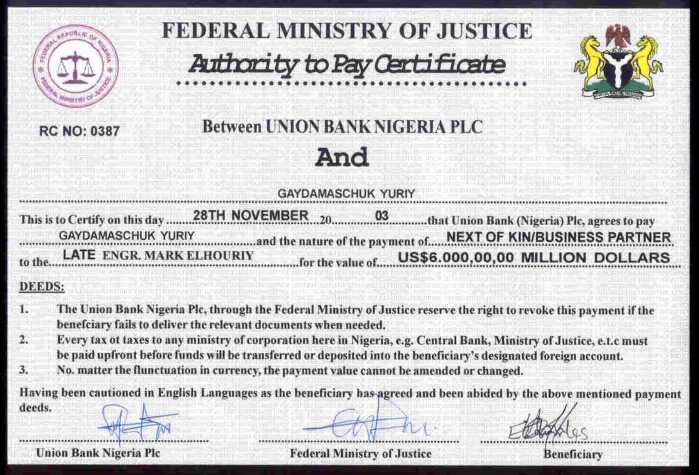

How to protect yourself from Nigerian Counterfeit Check Fraud : Overpayment Fraud)

Posted On Friday, June 01, 2007 at at Friday, June 01, 2007 by UnknownHere's how it starts

You want to sell your old car, or Aunt Tillie's bureau, or those terrific dogs you breed? Just run an ad in any one of the online classifieds and you can reach an audience of thousands.

One of those thousands is a swindler who has been patiently watching his screen all morning, just waiting for you - and several hundred other people - to post an ad.

He or she will contact you by email or phone and offer to buy what you're selling, usually no questions asked, sight unseen. What a deal! Your item will be picked up on behalf of the so-called buyer by someone local. As for the payment, you'll be sent a check that's way over the amount you're asking. Please just go ahead and deposit the check and send the buyer the difference.

Where do these checks come from?

In the beginning, most of the checks arrived by mail with a return address of "Maryland, LAGOS." That is to say, they came from Nigeria but a quick glance would lead you to believe it arrived from the State of Maryland in the U.S.

The check forging rings are so widespread that members can be found just about anywhere. They stay in place on long enough to ensure the forged checks arrive at their destination. Most communication from the phony buyer is received via email, cell phone, and satellite phone.

Who says you can't cheat an honest man?

Most Nigerian scams rely on a certain amount of greed on the part of the target and a willingness to overlook the legal aspects of the proposal, such as ferreting illegally acquired funds out of Nigeria or other countries.

The Counterfeit Check scam, on the other hand, is based on the total honesty of the swindler's target which is you, the seller.

Following the buyer's request, you deposit the check into your account. If you have received a Cashier's Check or have an excellent credit record with your bank, the check will be credited to your account without delay. If the funds were wired directly to your account from another bank, then there is no question that the money is readily available.

You then immediately arrange for the excess funds to be wired to the bank account number the buyer has supplied to you for that purpose, or to forward the funds through Western Union. Your bank sends the funds out either that day or the following morning, or you run down to the nearest Western Union office to wire the funds to London or Italy or wherever.

Shortly thereafter you receive a call from the bank and the roof falls in on you.

Fact is, NO legitimate business transaction asks you to wire excess funds anywhere. It's simply not done for the basic reason that no legitimate business person is about to trust an absolute stranger with their money.

Who ends up paying the price?

In most instances, you are going to have to pay for the loss. That means you will have to make up for the amount that you wired - plus any of the money you spent. In rare instances, the bank will absorb the loss, but don't count on it.

The reason for this is that when you endorse a check, you are vouching for the validity of that check.

But what about Cashier's Checks? Or funds wired directly into your account? In those instances the liability is determined on a case by case basis. Some banks are on the alert for the scam, others are not. Nonetheless, the final responsibility lies with the depositor.

You see, the only responsibility a financial institution has toward its customers is to keep each person's funds accounted for and safe from harm. Those are the basics. Beyond that, there are Federal regulations, state regulations, and internal regulations. Laws are different for Credit Unions, Commercial Banks, and brokerage houses. Each is accountable to a different oversight organization.

Just one question: Why are there always Nigerians involved whenever there's talks of scams? Did you see the 20/20 on ABC about Nigerian email scams and such? I really was ashamed to be African after that...